Knowing Me, Knowing You: Theory of Human Mind and AI Interactions

According to ISG’s 2023 Future Workplace study, 85% of enterprises believe that investment in generative AI technology in the next 24 months is important or critical.

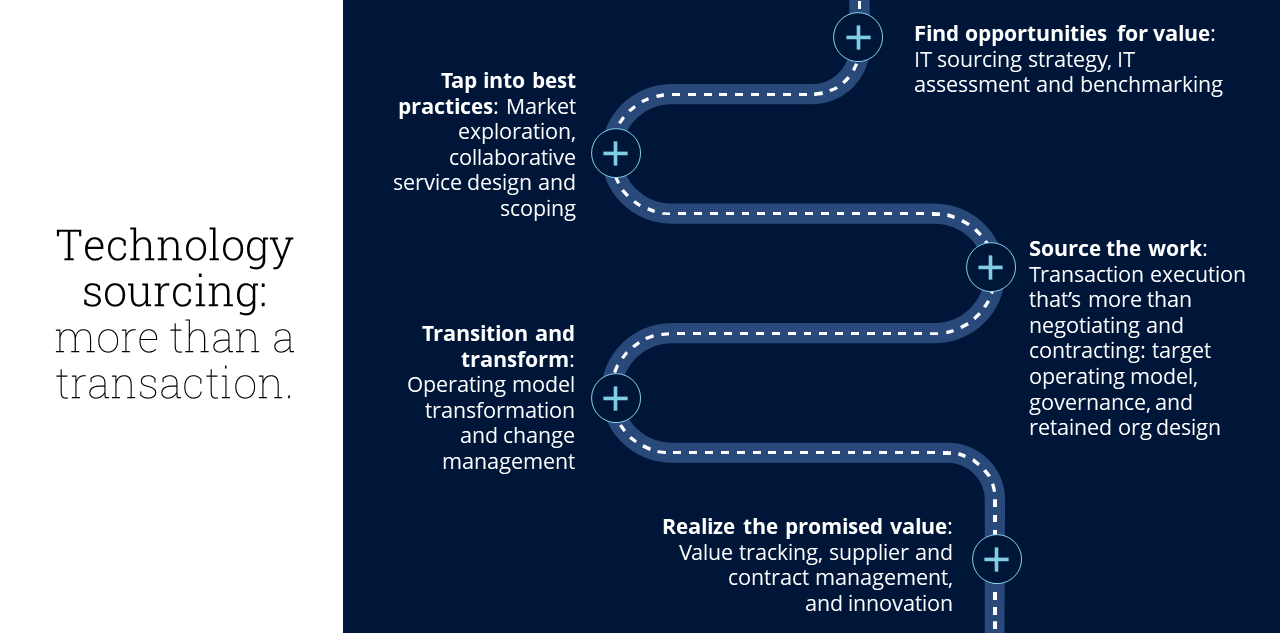

We help companies transform by providing project delivery resources who will improve your projects' profitability, optimize limited resources and achieve on-time delivery. Our leaders can assess, plan and execute your strategies, transition and vision.

We do this by defining a singular process in response to your technology, organization or process changes.

We’ll help you integrate planning and budgeting into your strategic goals, outlining a clear plan to achieving your outcomes.

Collectively, our resources will recommend and test solutions, ensuring that project objectives are delivered successfully.

Project Leadership

We’ll help you integrate planning and budgeting to your strategic goals, outlining a clear plan for successful outcomes.

Includes: Project Managers | Program Managers | Portfolio Managers

Business Processes

From mapping and defining current processes to optimizing, adopting and implementing new processes due to technology, organizational or process changes. A good process = great results!

Includes: Business Process Consultants

Positively impact your bottom line with our expertise. Contact us to learn more how we can help.

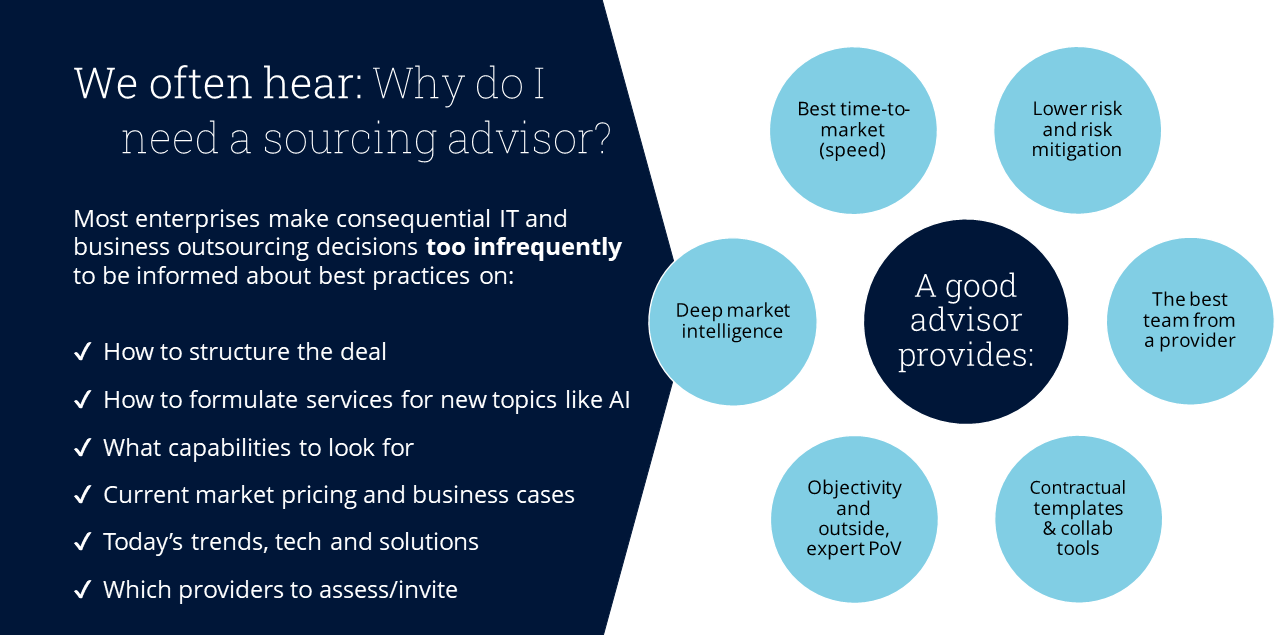

A leading European bank was struggling with dated technology, systems and processes. The bank had established a global capability center (GCC) for IT years ago, but it was facing challenges trying to gain access to modern capabilities at the scale required to fundamentally transform the way it was doing business. The Indian global capability center was barely managing to replenish attrition with new hires. Furthermore, the bank knew that its IT costs were significantly out of alignment with the market, and that it was missing out on innovation, efficiencies and therefore, a competitive edge.

The current model was simply not sufficient to support the bank’s new business strategy: to become a leading digital bank by 2028. Additional increasing regulatory pressures, such as the EU’s new Digital Operational Resilience Act (DORA), pushed the bank to realize that it needed to do something now.

The bank’s leadership team concluded that they needed to reduce technical debt by restructuring the IT footprint. To accomplish this, they would engage in a strategic partnership with a Tier 1 technology provider. The bank would not seek a typical IT outsourcing relationship with a buyer and supplier managed by a statement of work. Instead, it wanted a partnership in which both parties bring something to the table for mutual benefit and higher impact. The bank wanted to increase access to talent and modern capabilities like AI and cybersecurity, increase compliance, improve customer service and drive productivity – but it had never done outsourcing on this scale before.

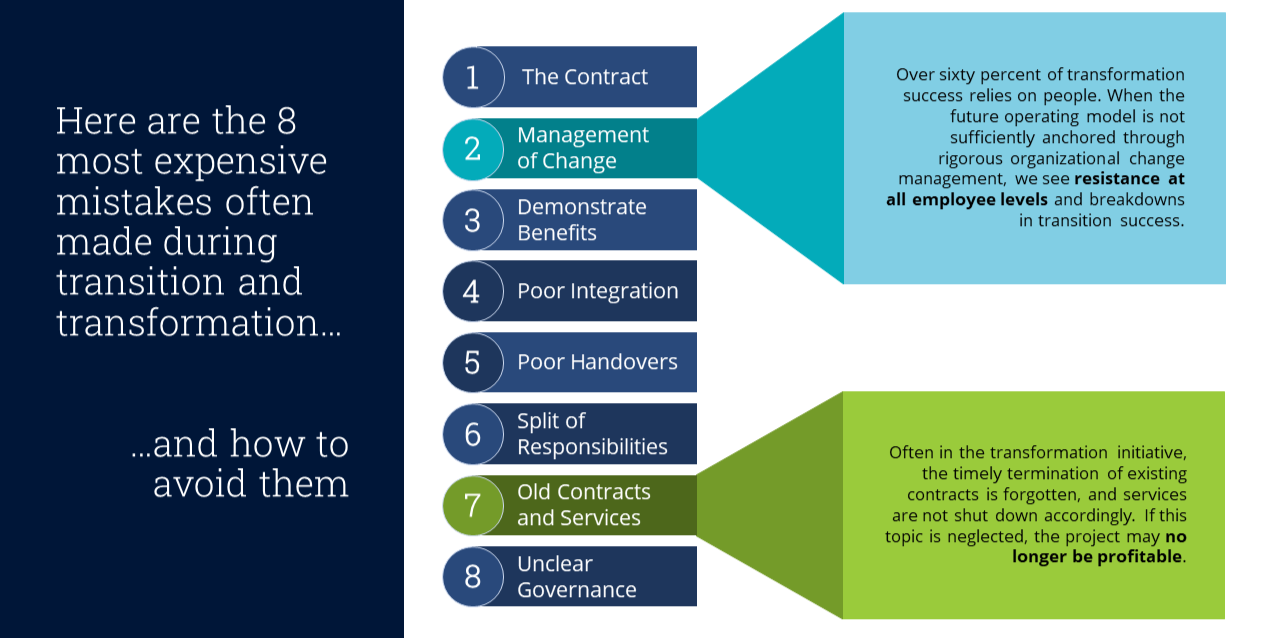

The bank first turned to a reputable business strategy consultancy, which produced a slew of presentations analyzing what the bank should do. But, as the strategy was built, there was significant internal resistance. Having never gone through such a large technology and organizational transformation before, tenured leaders at all levels were fearful of making significant changes to the existing operating models. And procurement was concerned because there was no drive toward implementation. That’s when ISG was brought in.

One of our first questions was: have you already spoken to technology providers to find out what it will take to implement this? The ISG team found that the bank, as relative newcomers to outsourcing, was overly cautious in taking action. We pushed the company to do a market exploration exercise to identify pragmatic but leading-edge solutions.

Market exploration involved ISG-facilitated workshops with several technology providers to establish an initial exchange on a potential scope and solution for how to transform the bank’s technology landscape. In these sessions, the bank explained its challenges and the providers explained how their solutions would address the challenges.

From this exercise, a few providers impressed the bank. ISG then helped co-create the solution, achieve alignment on the scope and execute a competitive request for proposals (RFP) process. According to the bank’s vision, the bank would award the business to just one provider for their entire IT portfolio, in part because it intended to sell its global capability center to the chosen provider. Not only did leadership want to create a long-term, strategic partnership that would improve customer experience, they also wanted to do right by their people. Both goals required a deep, mutual trust between the bank and the new provider.

To help get there, ISG recommended and helped the bank create contracts with two providers at the same time. This model created just the right amount of competitive tension to keep costs and terms reasonable. Our work included over 120 collaborative co-solutioning workshops to understand what was possible and scope the contract. ISG also helped define and document detailed yet flexible service-level agreements.

With our expertise in negotiating and contracting, the bank could ensure value to both the bank and the providers in terms of building a good foundation for a healthy, long-term relationship. After working through competitive contracting and negotiations, the bank ultimately downselected to one provider.

Throughout the market exploration and sourcing transaction, ISG became synonymous with “getting it done.” While other consultancies got replaced over time, the bank continued to trust and rely on ISG for a simple reason: we knew how to execute and make fast progress.

And ISG stayed deeply involved after contract signature as we supported the transition to the new provider taking place on schedule, on budget and functioning as initially planned. Our future-state operating model for the bank detailed everything that needed to be addressed for the partnership to succeed: new roles, processes, responsibilities, technologies and capabilities, and alignment on goals and key performance indicators to measure success.

Our team also provided rigorous organizational change management and communications to help the bank’s IT team understand and adopt all the new ways of working as a result of the transition. We helped transition nearly 1,350 team members from the global capability center to the provider and assisted the retained 50 people in adjusting to the new situation. In total, we designed and managed the transformation across 15 workstreams, from HR to IT.

As the bank’s trusted advisor, we took seriously our mission to help achieve the largest organizational transformation in the company’s history. When there were barriers to overcome, ISG knew which levers to use to get the teams unstuck and to stay on schedule. The bank relied on our depth of sourcing experience and implementation know-how to provide concrete actionable steps toward executing its plan.

In the end, the bank successfully transitioned its IT to its chosen strategic partner, enabling a more cost-effective model, improving customer experience and strengthening its competitive positioning in the market. Contact us to learn more about how ISG can help your business achieve its goals.