If someone forwarded you this briefing, consider subscribing here.

GLOBAL CAPABILITY CENTERS

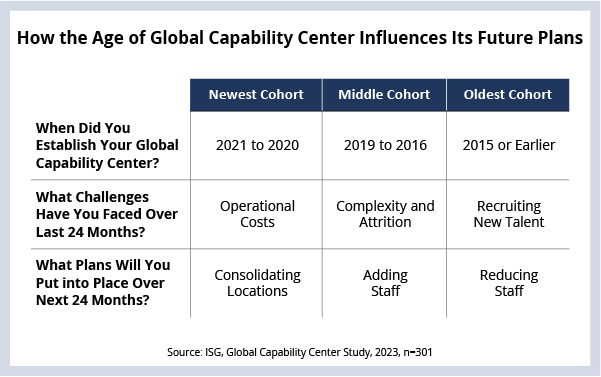

Enterprise activity around global capability centers (GCCs) continues to be very robust. ISG data show that a GCC faces different challenges depending on how long it’s been in operation. Newer GCCs struggle with costs and complexity, while older GCCs struggle with recruiting and retaining talent.

DATA WATCH

Robust GCC Market Activity

As we discussed on the 3Q23 Index call, enterprise activity around global capability centers is at an all-time high. The unprecedented activity we’re seeing in the market and in the data includes not only enterprises that want to build or expand GCCs but also ones that want to close or sell them.

Both groups are facing challenges in an environment where talent is at a premium and cost optimization needs to happen immediately. But the challenges each group is facing – and plans they are developing over the next 24 months – vary depending on how long the GCC has been in operation.

Age Influences Future Plans

When looking at GCC challenges in this context, an interesting pattern emerges. Of course, not all GCCs follow this path – but many do – and it’s our view that this path is one of the primary drivers behind the recent wave of GCC activity:

The Newest Cohort (established in 2020 and 2021) is primarily facing cost challenges related to GCC operations. This is due in part to the rapid rise in salaries in India during the post-pandemic boom, which led to the Great Reshuffle. The newest cohort plans on consolidating operations into fewer locations over the next 24 months, likely in response to these cost pressures.

The Middle Cohort (established 2016 to 2019) is facing operational complexity and attrition challenges. As cost pressures mount, firms are moving more work to their GCCs, while at the same time, the GCC itself is struggling to hold on to existing employees. In this cohort, a majority is planning to add staff while a smaller percentage is planning on reducing staff.

The Oldest Cohort (established 2015 and earlier) is struggling most with recruiting talent and, to a lesser degree, operational complexity. Typically, the promotion path inside of a GCC will be slower than inside a managed services provider. This fact could be having an outsized impact on older GCCs, especially when viewed through the lens of the recent boom in lateral hiring in 2021 and 2022. Over the next 24 months, this cohort is planning on reducing staff, with a small percentage planning to add staff.

What’s Next

As we discussed on the call, global capability centers are just one component of a much larger conversation about risk, cost, service delivery management and strategy realization. Providers that can help their clients work through these factors – and stay flexible on both delivery and commercial models – will gain advantage in this talent-constrained, cost-conscious environment.