If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CLOUD

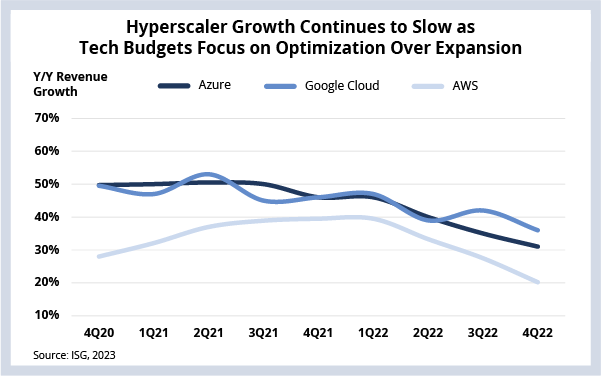

Hyperscaler growth continues to slow as tech budgets focus on optimization over expansion.Background

As we’ve discussed, demand for cloud exploded post pandemic as companies looked to use cloud to turbo charge their transformations. However, the rapid adoption of cloud was often done in the context of a “framework agreement” with one or more of the large hyperscalers.

These agreements represent a commitment to a certain level of spending over a fixed period of time. That spending can only be realized if the services are consumed – which means applications must get moved, created and scaled fast enough to match up with the timeline of the commitment.

This, combined with the macroeconomic picture, means that companies are now focusing on optimizing what they have – rather than buying new. And this is having an impact on the hyperscalers, who are now seeing growth trajectories slow for the first time in history.

The 4Q22 Details

- AWS grew 20% Y/Y, compared to 28% 3Q22. A primary driver for the slowdown was customers focused on optimizing existing workloads.

- Azure grew 31% Y/Y, compared to 35% in 3Q22. Azure’s commercial bookings growth rate was the lowest it’s been in five years.

- Google grew 36% Y/Y, compared to 42% in 3Q22. Google saw enterprise momentum in the fourth quarter, but margins in its cloud business continue to be negative.

The big question remains: what impact will this slowdown have on the IT and business services sector, where hyperscaler opportunities now represent a double-digit percentage of provider pipelines?

As usual, the answer depends. Provider consulting and systems integration opportunities will certainly continue to be under pressure. But this is not due solely to slowing growth in cloud. The macro situation is impacting discretionary consulting and SI-related work across the board (and is one of the reasons for the concurrent slowdown in SaaS).

The answer is different for outsourcing and could be more positive. As we discussed last April, we continue to see many enterprises lifting and shifting applications to cloud. Over 60% of enterprises use lift and shift as one of their preferred approaches to moving applications to cloud.

However, the lift-and-shift approach, which is often spread across multiple clouds, can create some significant side effects. Unexpected costs, security concerns and lack of scalability can all result when organizations fail to re-architect applications to take advantage of the unique attributes of cloud.

And it’s this trend that could actually benefit some providers’ outsourcing businesses. Enterprises are increasingly recognizing the need, in light of the recent pains caused by quickly lifting and shifting workloads to fulfill framework agreements, to take an application-centric approach to their infrastructure decisions.

Companies’ insufficient cloud preparedness – combined with the immediate need to optimize costs in the near term – could be a signal that a new wave of applications outsourcing, which is already now over 60% of the ACV in the sector, is set to grow even bigger as firms look to solve for these dual challenges.

All that said, it’s important to keep in mind that the majority of this cloud slowdown is macro related. Enterprises are looking for ways to optimize costs, and cloud is one expense that companies can optimize, given the overcommitments that many made post pandemic. But cloud is – and will continue to be – the fundamental technology that companies use to drive innovation and value.

DATA WATCH