Indian biotechnology firm Bharat Biotech announced this week that trials of its COVID-19 vaccine are showing 81 percent efficacy at preventing infection. Here’s a shout out to all our friends, families and co-workers in India on a successful and rapid deployment of the vaccine!

Here’s what’s important in IT and business services this week:

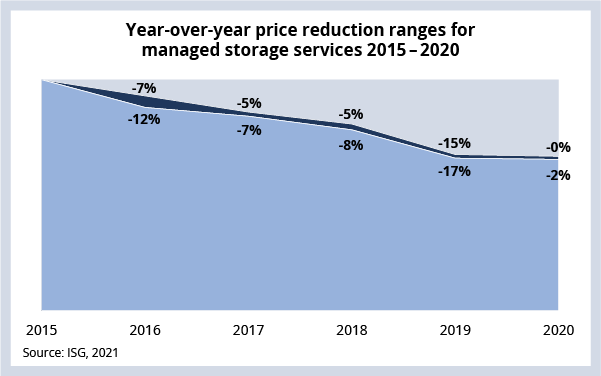

- Managed storage services price declines are slowing

- Wipro bookings are a harbinger for consumer services

- Microsoft Power Automate is free for Windows 10 users

- Amadeus taps Microsoft for travel technology transformation

PRICING

Prices for managed storage services have been declining for years – outpacing the year-over-year reduction we’re seeing across all other IT services towers. There are a couple of reasons for this.

First, service providers routinely offer aggressive pricing discounts on managed storage services knowing that storage volumes will increase as consumption rises. Second, there has been a ton of technology innovation in recent years that is driving down the per-gigabyte price. For example, virtualizing flash storage, which creates higher capacities (and better performance), reduces the price per usable GB.

Interestingly, year-over-year price decreases are showing signs of slowing (see Data Watch section) as most labor-related efficiencies have been squeezed out of this tower.

What it means for enterprises: Pricing concessions on managed storage services may be limited for the foreseeable future.

What it means for providers: Providers that can help their clients manage consumption can add a lot of value as enterprises struggle to control data sprawl.

Our POV: The issue here is the enduring myth that storage is cheap. Managing storage as a corporate resource has not been a priority, and the tooling to manage storage usage has been weak. Data management does need to reside with the enterprise, but providers can – and should – bring valuable expertise in this space. Ultimately, data protection, backup and recovery processes need to align to the business value of the data.

DATA WATCH

PROVIDER SPOTLIGHT

Over the past several months, Wipro has racked up some impressive wins: a five-year modernization deal at German telecommunications firm O2, a multi-tower deal at German wholesaler Metro AG and, most recently, a $500 million ADM and infrastructure management services deal at cosmetics maker Estee Lauder.

The Metro and Estee Lauder bookings build on recent growth for Wipro’s $1.2 billion consumer business unit, which reported 5 percent quarter-over-quarter growth in a January earnings call.

We’re forecasting 3.5 percent growth for CPG firms in 2021 – and up to 5.6 percent in 2022 – as they realign supply chains for online fulfillment. Digitization of manufacturing systems and automation at the production level will be the target of significant investment over the next several quarters.

AUTOMATION

Microsoft announced this week at its annual Ignite Conference that its low-code robotic process automation functionality Power Automate Desktop will soon be included in Windows 10 for free. This will no doubt foster the citizen development movement by reducing the barrier to entry for desktop-based automation.

Power Automate Desktop functionality is limited to PC-based applications, which clearly targets business users. This is not a move by Microsoft to take on enterprise-grade automations (yet), a market currently dominated by RPA software developers Automation Anywhere, UiPath and Blue Prism.

Microsoft got a late start in the RPA space, but the acquisition of Softomotive in 2020 gave it some much-needed enterprise credibility. We’re watching this space closely as Big Tech starts to step into a space that the Big Three have owned for years.

DEAL ACTIVITY

- Amadeus and Microsoft. Spanish travel technology firm focuses on personalized services and joint product development while moving its platform to Azure. Link

- Google and Infosys. Search giant signs $500 million deal for engineering support services. Link

- KONE and Orange Business Services. Finnish engineering services company moves contact center to the cloud. Link

- GEFCO and Capgemini. European automotive logistics renews relationship with a focus on infrastructure modernization via multi-cloud transformation. Link

- Airbus and L&T Technology Services. European aerospace firm expands its Skywise platform. Link

- Schrödinger and Google. U.S. life sciences company expands its relationship with the goal of increasing the speed of its drug discovery and materials science platform. Link