Here’s a shout out to family, friends and colleagues in the Mid-Atlantic and Northeast U.S. who are recovering from the historic storm that hit their region this week. Stay warm!

And here’s what’s important in IT and business services this week:

Atos walks away from DXC

Amazon gets a new CEO

EU data-flow negotiations underway

Transition services post-COVID-19

M&A

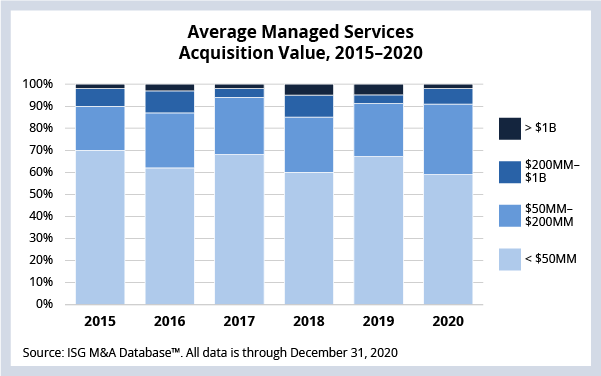

Atos walks away from DXC. As we discussed a couple weeks ago, Atos + DXC would be one of the largest acquisitions in the history of the IT services market. Deals of this size are few and far between. In 2020, less than two percent of all M&A activity in managed services had valuations greater than $1 billion (see Data section below). While there were compelling reasons to combine Atos’ European footprint with DXC’s strong U.S. presence, this deal likely died because of DXC’s low valuation.

It has been reported that Atos’ offer was in the $10 billion range. Based on DXC’s services mix, which includes a number of declining services, the multiplier for this deal was probably in the .5X to .7X range. Historically, IT services acquisitions have a multiplier of something closer to 1.2X. DXC likely felt it was being undervalued, and Atos likely felt it was paying too much.

Keep an eye on this when we report results for the Q1 2021 Index on April 7. Historically, when a large acquisition (or spinoff like IBM NewCo) is announced, new bookings suffer as enterprises delay decision-making.

DATA

LEADERSHIP

Amazon gets a new CEO. On the heels of its first-ever $100 billion quarter, Amazon CEO Jeff Bezos announced he is stepping aside, and that Amazon Web Services boss Andy Jassy will take over. AWS Q4 results were very strong – though lower than some consensus estimates – at $12.7 billion.

AWS’ backlog is over $50 billion. This backlog makes up a substantial portion of the IaaS growth we’re seeing in the market, which we reported a few weeks ago was up 23 percent annually.

Jassy has a big job in front of him. He must continue to grow the profit machine of AWS (which is responsible for over 50 percent of Amazon’s operating income) while Microsoft and Google continue to invest billions and move in on its market share. Big tech regulation is also front and center, as governments across the globe are increasingly turning an eye toward assessing market competition, ensuring data privacy and reducing the spread of misinformation.

POLICY

EU data-flow negotiations underway. Negotiations focused on personal data transfers are underway between the EU and the U.S./U.K. The U.S. talks are focused on intelligence-gathering practices. The U.K. talks are focused on ensuring personal data can continue to flow once the recently executed Trade and Cooperation Agreement (TCA) expires in June.

The results of these negotiations will have a big impact on the growth of as-a-service offerings in Europe, where the annual growth rate of IaaS is nearly doubling. Meanwhile, work continues on creating a next-generation data infrastructure for Europe.

PRACTITIONER'S POV

Transition services in post-COVID-19. As we discussed on the Q4 Index call, we’re seeing providers deliver transition services 100 percent virtually (something unthinkable a year ago). And, in many cases, we’re seeing transition excellence during the pandemic.

My long-time colleague and highly respected workplace guru Jim Kane has developed a transition acronym that has held true for many years. And it has not changed – even during Covid-19.

It’s called PANTS.

Processes must be owned, managed and updated by both client and service provider.

Access must be granted to the right people, at the right time.

Network bandwidth must be fast and reliable, now even more than ever as provider personnel are working from home.

Tools supplied by the provider need to be vetted and rationalized by client security teams, installed by client workplace personnel and made available with the right number of software licenses for the provider.

Staffing the transition team, ensuring service level set up and eventual transition to steady-state operations is critical.

Thanks for the great advice on PANTS, Jim!

DEAL ACTIVITY

- Tech Mahindra and RSA Scandinavia. Nordics insurer is modernizing its mainframe. Link

- AMP and AWS. Australian financial services company will move 100% of its on-premises workloads to AWS by 2022. Link

- Siemens Gamesa and Infosys. Wind power firm will replace two legacy ERP systems with a single SAP S/4HANA instance across 50 countries. Link

- Getinge and Orange Business Services. Swedish medical technology firm is responding to rapidly changing network patterns during the pandemic with a large-scale SD-WAN deployment. Link

MORE MERGERS, ACQUISITIONS AND ALLIANCES

- Sanofi, Capgemini, Generali and Orange launch digital e-health initiative. Joint venture between biopharmaceutical, insurance, telecommunications and IT services firms. Link

- HCL partners with Finastra for cloud-based treasury. HCL makes a move into the hyper-competitive core banking implementation market. Link

- Deloitte acquires cybersecurity firm R9B. One of the Big Four goes threat hunting. Link

- SAP buys German business process software firm Signavio. Process mining becoming mission-critical in the business process management (BPM) space. Link

- Microsoft is putting Teams into SAP. Existing partnership appears to be deepening. Link