Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What Uncertainty Is Doing to Discretionary Spending

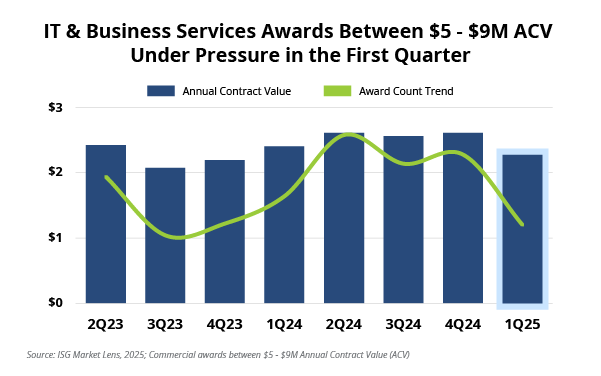

Discretionary IT spending was beginning to recover in 2H24 until it started to slow again in 1Q25. Increased business uncertainty introduced by U.S. tariffs in April will likely put even more pressure on technology services spending in 2025.

Data Watch

Background

Awards between $5 - $9 million ACV represent an important indicator for the health and growth of the IT and business services sector. Over the years, we have found this award size range to be a good proxy for “discretionary” spending.

And while this award range began to recover in the second half of 2024, it declined again in the first quarter of 2025 (see Data Watch), on both ACV and award counts.

The Details

- On an industry level, ACV for awards between $5 - $9M was down 6% Y/Y and 13% Q/Q.

- Most of that decline was focused on the EMEA region (ACV down 2% Y/Y and 15% Q/Q) and the Asia Pacific region (ACV down 27% Y/Y and 40% Q/Q).

- In BPO, ACV in this range was down 39% Y/Y and 41% Q/Q.

What’s Next

What’s different about this current dip in discretionary spending is that, at least for now, it’s localized to a few regions and service lines. We’re watching this closely to see how (and if) the increasing levels of business uncertainty caused by tariffs spill out into broader areas of IT and business services, such as applications, or into the Americas region.

That said, the ongoing business uncertainty the market is experiencing now may also create opportunity for service providers. In January, just 12% of U.S. CEOs planned on decreasing capital expenditures over the next 12 months. Now over 40% say they will.

This kind of environment creates pressure on smaller, discretionary awards, but it also usually represents an opportunity for providers to shape larger deals that deliver near-term savings in exchange for longer-term commitments. And this in turn helps capital-strapped enterprises modernize their technology and business operations.