Over the past 18 months or so, we’ve seen growth in the number of mergers and acquisitions (M&A), principally in sectors such as Private Equity and Technology. Though the first half of 2022 saw a slowdown due to higher interest rates and a volatile stock market, we expect the demand to increase again toward the second half of the year as potential acquirers put their substantial cash reserves to use once again.

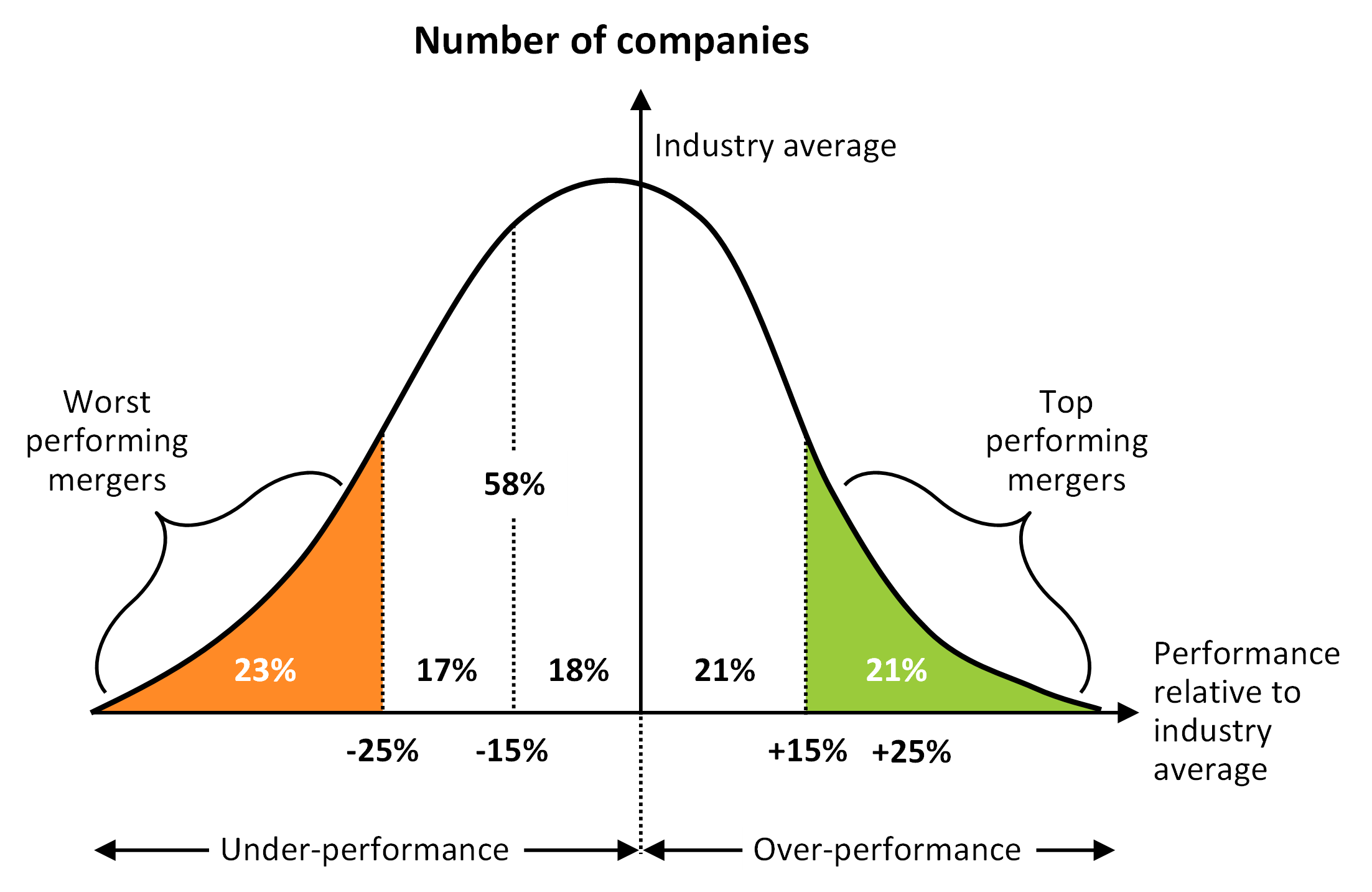

The goal of most companies going through an M&A activity is to achieve synergy targets in order to expand. Among recent M&As, there is only a small percentage of acquired companies that will realize an increase in profitability after a transaction integration. In fact, research shows that just over 20% of acquired companies deliver superior returns to their shareholders.

Source: Global PMI Survey; Datastream

This means that nearly 80% of acquired companies do not deliver the expected returns to their shareholders months after the M&A activity has closed. There are a host of reasons why returns may not be achieved, including:

- Cultural differences between the two companies

- A focus on blind cost-cutting instead of revenue-driving initiatives

- Failure to push for synergies

- Poor communication about the integration processes

- Slow-paced integration effort

- Insufficient resources dedicated to the integration

- Failure by management to address/resolve conflicts/issues

- Loss of autonomy of acquired managers

- Weak retention of best people in the acquired company

- Weak original strategic rationale for the merger

The good news is that most of these issues can be addressed through a strategic cost optimization program. When it comes to successful M&A activities and delivering savings, enterprises must define specific cost-cutting initiatives and clarify expected integration synergies.

Rigorous and targeted cost optimization strategies

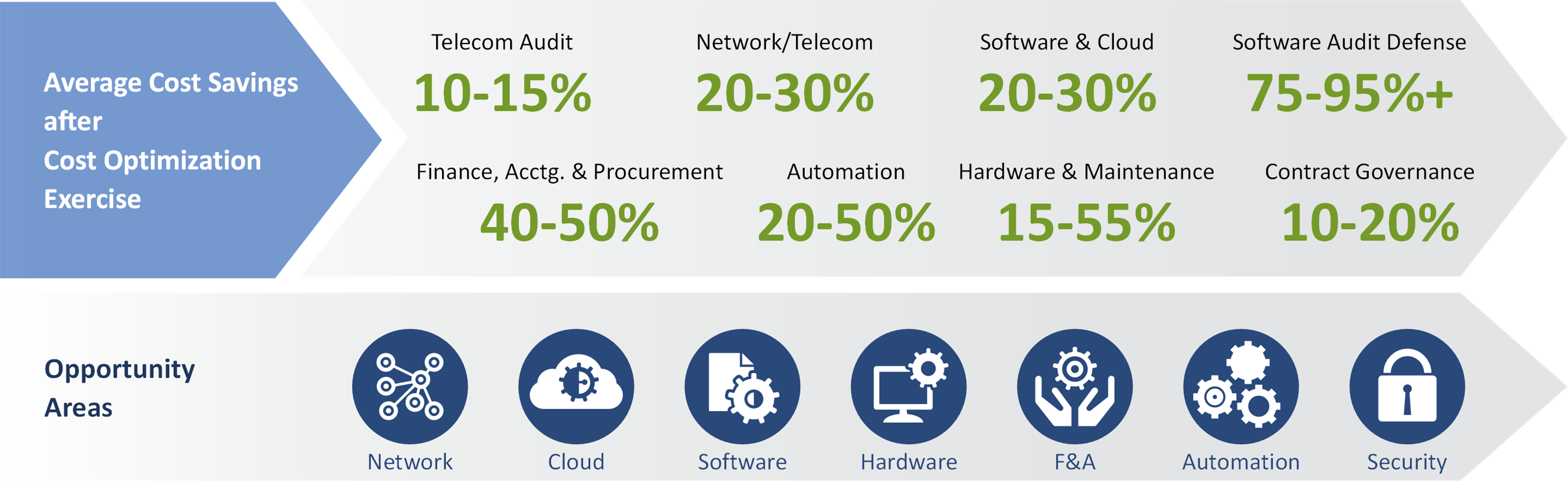

There’s tremendous opportunity for acquiring entities to gain synergies and significant savings. But, for this to happen, the acquiring entity must implement targeted cost optimization strategies across multiples areas (telecom, network/software, cloud, hardware, maintenance, finance and accounting, HR, including an automation, etc.) into the new post-transaction target environment.

Begin by clearly defining the new cost optimization strategies, the organizational and review management principles and the new culture. Make sure both parties are in agreement on the cost optimization strategies, the integration principles and the rules of the road by defining the structure of the integration plan. This should include the value creation objectives, the related initiatives and the speed of implementation – and, of course, the role of management. Clarify the new organization and ensure fairness in the selection of people. Identify and manage cultural differences and barriers to change. Create single points of accountability and communicate consistently. Lastly, monitor the cost optimization program over time to ensure savings are ongoing.

Although there is no silver bullet that will provide the desired amount of savings, a targeted cost optimization program and roadmap will deliver the optimal amount, drive shareholder value and prepare the organization to sustain growth as a result of the planned synergies.

Organizations that implement a targeted cost optimization program often experience significant improvements in service quality, reduction in technical debt and greater ability to leverage scale and responsiveness to business demand.

ISG clients save in the areas listed below:

Figure 1: Areas to Achieve Cost Savings During M&A

At ISG, we help our clients implement various cost optimization programs that enable rapid integration or separation of business capabilities to provide the desired level of savings and optimize the planned M&A synergies. Our services can help position your organization for sustained growth from both an M&A perspective as well as ongoing operations. Contact us to find out how we can help you.